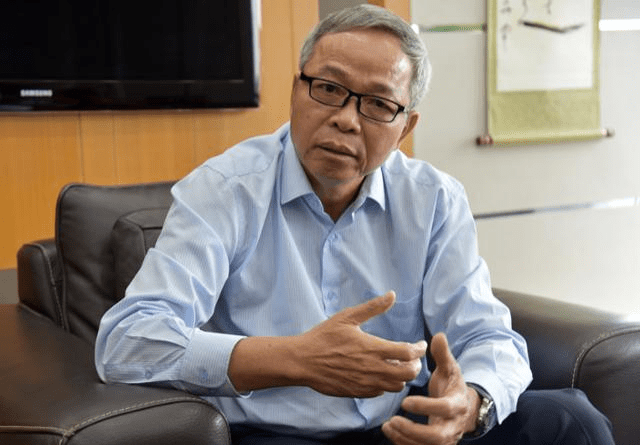

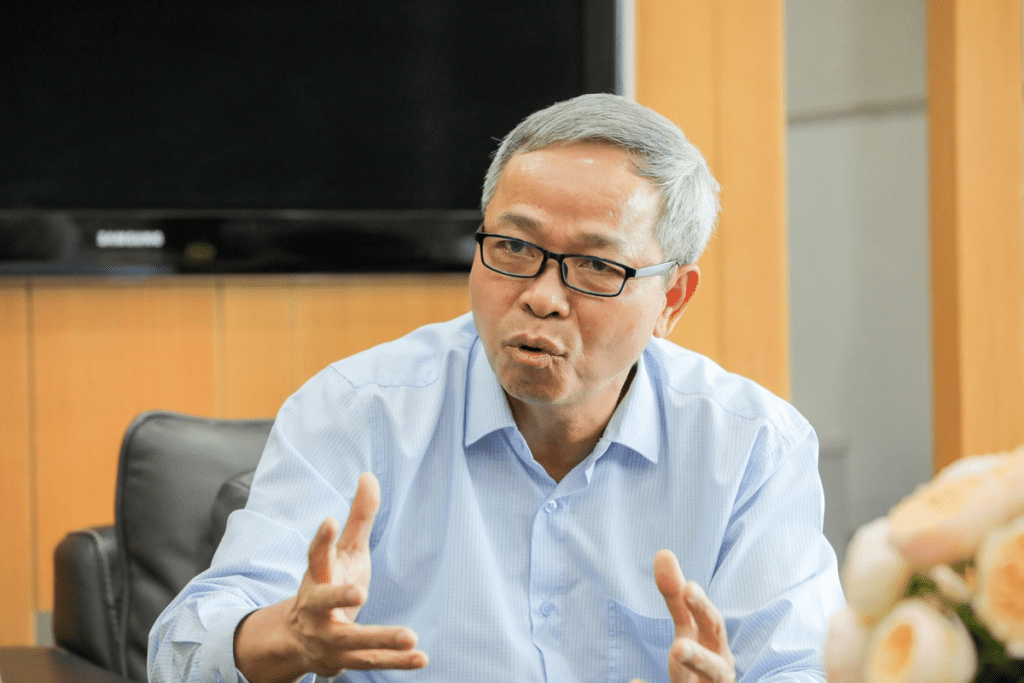

[Interview with Nguyen Trung Chinh, Chairman of Vietnam’s CMC Corporation]

Cooperation with major Korean conglomerates in Vietnam

On 8th May 2024, CMC Global will directly enter Korea to secure customers

Among the ten member states of the Association of Southeast Asian Nations (ASEAN), Vietnam stands out as the country with the fastest-growing digital economy. The Vietnamese government has set forth a vision to transition into a ‘high-income industrialized nation’ by 2045, with ‘digitalization’ as a core driving force.

In this landscape, CMC Corporation, a leading IT services company, stands at the forefront of Vietnam’s digital industry. The cloud platform developed by the company over the past decade holds a remarkable 25% market share domestically. It operates state-of-the-artdata centers, notably in Hanoi and Ho Chi Minh City, which are among the largest in Southeast Asia.

CMC Corporation also shares a deep connection with South Korea. Over the past two decades, it has formed partnerships with major Korean conglomerates, financial institutions, and telecommunication companies, supporting them in deploying IT services and expanding their businesses in the Vietnamese market. Building on this experience, CMC Corporation will officially launch its Korean subsidiary, ‘CMC Korea,’ on the 8th of next month, to enter the Korean market in earnest.

Nguyen Trung Chinh (left), Chairman of Vietnam’s CMC Corp, and Hong Won-pyo, former CEO of Samsung SDS, shake hands after signing a strategic investment agreement in Hanoi in August 2019. (Provided by Samsung SDS)

During a meeting at CMC Corp headquarters in Hanoi on the 24th, Chairman Nguyen Trung Chinh, emphasized, ” CMC Korea will be the ‘missing puzzle piece’ that assists our Korean partners in securing high-quality human resources at reasonable costs, enabling them to provide solutions to their customers.”

___________________

20 years of cooperation with Korea

Established in 1993, CMC has been collaborating with Korea for 20 years. CMC is an IT service company that provides technology solutions such as system integration (SI), software development, data centers, and digital infrastructure operations to companies in various sectors including finance, IT, and manufacturing. With a workforce of over 5,000 employees, its annual revenue reached approximately $332 million (about 460 billion won) last year. In Vietnam, it is ranked as the second-largest company in the ICT sector, following FPT.

In South Korea, CMC has gained recognition through its strategic partnership with Samsung SDS. In August and September of 2019, Samsung SDS acquired a 30% stake in CMC (approximately 250,000 shares) over two transactions. These two companies have collaborated across various fields including cloud, security, content management services (CMS), artificial intelligence (AI), IoT, and big data.

A view of the CMC Group data center (Source: CMC Corporation)

______

“Reducing Production Costs through Technological Expertise”

With established collaborations with Korean companies, why is CMC choosing to establish a subsidiary in Korea? Chairman Chinh explained, “Northeast Asian countries like Korea, Japan, and Taiwan are crucial markets,” noting, “Korea, in particular, lacks advanced industry-related talent despite being a leading IT nation, making the potential for business expansion significant.”

While targeting Korean companies that have ventured into Vietnam was the focus in the past, CMC now aims to directly enter the Korean market to actively seek customers. This move signifies an expansion strategy, positioning Korea as a forward base for collaborating with global companies. Chinh outlined plans to increase CMC’s workforce to 15,000 employees by 2028, with 2,500 deployed in the Korean market. He stated, “We aim to grow the Korean market to represent 25-30% of our total overseas market.”

CMC Corporation’s cybersecurity subsidiary, ‘CMC Cybersecurity,’ presents its employees at work. (Source: CMC Corporation)

A notable competitive edge compared to other firms is its pricing strategy. Chairman Chinh stated that CMC’s production value would differ by approximately 20-30% compared to Korean or Japanese firms with similar capabilities in the global market. However, he emphasized numerous times that this difference isn’t solely due to lower labor costs. “CMC doesn’t rely on a competitive strategy based on cheap labor in the global market,” he clarified. “Instead, we concentrate on enhancing productivity to offer customers economical and rational costs.”

He further stressed, “Our production value surpasses that of companies with similar qualifications in the Korean and Japanese markets.” This highlights the importance of guaranteeing employee productivity and increasing speed and efficiency to provide customers with economical and rational costs. The ability to lower production costs isn’t merely due to lower salaries for developers but rather achieved through superior technological expertise, enabling us to maintain a competitive pricing advantage.