As the US economy faces a slowdown, with GDP growth projected to decelerate to 1.5% in 2025, technology adoption presents a vital opportunity for banks to manage costs and drive sustainable growth. With rising cost pressures and evolving market dynamics, banks must embrace technologies like Artificial Intelligence (AI) and Machine Learning (ML), Robotic Process Automation (RPA), and Low-code/No-code Platforms to enhance labor productivity, optimize operations, and streamline processes.

Top 3 Tech Trends in the BFSI Industry of the US in 2025

Tech Trend #1: Artificial Intelligence (AI)

AI is at the forefront of digital transformation in the BFSI sector, offering unprecedented opportunities to enhance decision-making, improve customer service, and optimize internal processes.

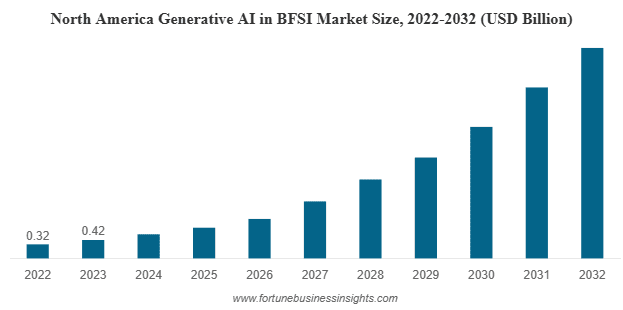

The global market for generative AI in the BFSI sector was valued at USD 1.01 billion in 2023 and is expected to grow from USD 1.38 billion in 2024 to USD 13.57 billion by 2032, reflecting a CAGR of 33.1%. In 2023, North America led the market, accounting for 41.58% of the global share.

Source: Fortune Business Insights

Applications:

- Fraud Detection: AI-powered algorithms can detect suspicious patterns in transactions, preventing fraud before it occurs.

- Risk Management: AI helps assess and mitigate financial risks by analyzing vast amounts of data and identifying trends that humans might miss.

- Personalized Services: Banks and insurers use AI to create tailored products for customers based on their behavior, preferences, and financial history.

- Customer Service: Chatbots and virtual assistants powered by AI are revolutionizing customer support, providing 24/7 assistance and improving response times.

Benefits:

- AI and ML enhance predictive analytics, enabling institutions to make more informed, data-driven decisions.

- Automation of repetitive tasks frees up human resources for more strategic roles.

- With better data analysis, AI helps institutions improve customer experiences through personalized offerings.

Examples:

JP Morgan uses AI to streamline its risk assessment processes, reducing manual errors and speeding up decision-making, reporting a 10-20% increase in product application completion rates through AI-driven customer engagement tools.

Tech Trend #2: Robotic Process Automation (RPA)

RPA is transforming the BFSI industry by automating routine, rule-based tasks, allowing organizations to improve operational efficiency and reduce costs.

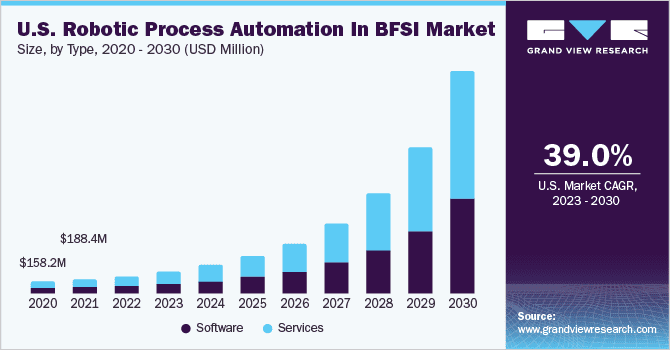

The global market for robotic process automation (RPA) in the BFSI sector is projected to reach USD 8.79 billion by 2030, growing at a compound annual growth rate (CAGR) of 39.0% from 2023 to 2030, according to a report from Grand View Research.

Source: Grand View Research

Applications:

- Back-office Operations: RPA can automate functions like transaction processing, account reconciliation, and compliance reporting, which were once time-consuming and error-prone tasks.

- Customer Onboarding: RPA can simplify the customer onboarding process by automating KYC (Know Your Customer) checks, document verification, and data entry.

- Claims Processing: In insurance, RPA can streamline claims management, from document collection to payout processing, reducing manual errors and speeding up the process.

Benefits:

- RPA leads to cost savings, as automation eliminates the need for human intervention in routine tasks.

- It increases accuracy by minimizing human errors and improving consistency in operations.

- With RPA handling mundane tasks, employees can focus on more high-value activities, boosting productivity.

Examples:

Bank of America uses RPA to improve customer service by automating tasks such as fraud detection and loan processing.

Tech Trend #3: Low-code/No-code Platforms

Low-code and no-code platforms are democratizing the development of applications, allowing non-technical users to build, customize, and deploy applications without extensive coding knowledge.

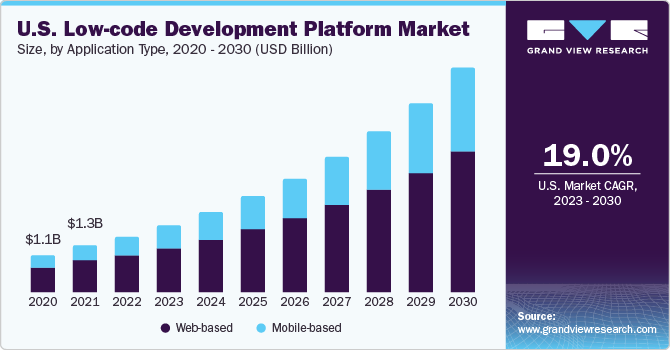

According to recent market reports, the US low-code/no-code market within the BFSI (Banking, Financial Services, and Insurance) sector is estimated to be around $4.5 billion in 2024, with a projected significant growth rate of 27.8% CAGR until 2034, potentially reaching a market size of $52.2 billion by then.

Applications:

- Customer-Facing Solutions: Low-code/no-code platforms enable banks and insurance companies to rapidly create and deploy mobile apps, customer portals, and self-service tools that enhance customer engagement.

- Internal Workflow Automation: These platforms help automate internal processes, such as document management, data analytics, and reporting, without requiring developers.

- Prototyping: Rapid prototyping of new financial products or services can be achieved in a fraction of the time it would take using traditional development methods.

Benefits:

- Speed: Low-code/no-code platforms enable faster development and deployment cycles, allowing BFSI organizations to respond to market demands quickly.

- Cost-Effectiveness: Reduces reliance on highly skilled developers, cutting down on development costs.

- Agility: Businesses can quickly adapt to changing needs and customer demands by building and modifying applications in real-time.

Examples:

Citibank has used low-code platforms to streamline its product development and improve time-to-market for new financial services.

Challenges in Adoption

While the benefits of these technologies are undeniable, their adoption is not without challenges. Some of the key hurdles in the BFSI sector include:

- Regulatory Compliance: The BFSI sector is highly regulated, and integrating new technologies like AI, RPA, and low-code platforms must align with compliance standards.

- Integration with Legacy Systems: Many financial institutions still rely on legacy systems, and integrating modern technologies with these old infrastructures can be complex and costly.

- Talent Shortage: The demand for professionals skilled in AI, RPA, and low-code development is growing, but there is a shortage of talent capable of implementing and managing these technologies effectively.

Looking to go digital

The adoption of AI, RPA, and low-code/no-code platforms is transforming the BFSI sector in the US, driving efficiency, cost savings, and improved customer experiences. However, integrating these technologies into existing systems can be challenging.

At CMC Global, we help BFSI organizations navigate these challenges and successfully implement emerging technologies. With our expertise, we provide tailored strategies that ensure smooth integration, reduce risks, and maximize business impact. Whether optimizing operations or enhancing customer experiences, CMC Global supports you throughout your digital transformation journey.

Contact us for a free consultation and see how we can help your business transform!