Germany, known for its stringent quality standards and focus on innovation, has recognized Vietnam’s unique potential as a reliable and capable partner for IT services. This article will explore why German companies are embracing Vietnam as their next IT hub, analyzing the appeal of the China + 1 strategy, and the specific strengths of Vietnam’s growing IT talent pool.

Germany’s Move to Vietnam: A New Investment Frontier

German investment in Vietnam saw significant growth after the country joined the World Trade Organization in 2007, further boosted by the 2020 EU-Vietnam Free Trade Agreement. Currently, approximately 380 German companies have invested a total of $2.7 billion in Vietnam (adjusted overall value beyond foreign direct investment), generating around 47,000 jobs.

Data from Trading Economics reveals a steady growth in trade between Germany and Vietnam, climbing from just over $1 billion in 2000 to an impressive $18.6 billion by 2023. This strong upward trend has attracted a range of companies specializing in machinery, chemicals, and food industries, all keen to tap into Vietnam’s expanding market and seize new business development opportunities.

In May 2024, Deutsche Bank significantly increased its capital investment in Deutsche Bank Vietnam, raising it to over $200 million. Moreover, Leonhard Kurz, a German specialist in hot-stamping and thin-film technology, has committed around $40 million to set up a production facility in Vietnam.

As global business strategies evolve, German companies have increasingly sought new destinations for IT outsourcing beyond traditional markets. One standout strategy driving this shift is the “China + 1” model, where companies diversify their manufacturing and service operations by supplementing operations in China with another Asian country. Among Southeast Asian regions, Vietnam has emerged as a promising “Plus One” destination.

Vietnam – A Natural Fit for The China+1 Strategy

For the past three decades, German companies have invested heavily in China, but this approach brought exposure to a variety of risks from both internal and external changes within China.

These days, three key trends in China are driving German firms to re-evaluate their operations there:

- Rising labor costs

- Changing investment environment (including a sense of “unwelcomeness” for foreign investors)

- Sudden disruptions like the introduction of environmental regulations in 2018, the U.S.-China trade dispute since 2019, and the COVID-19 pandemic in 2020.

In response, German companies are exploring additional locations for manufacturing and sourcing, often turning to Southeast Asia—with Vietnam emerging as a leading choice under the China + 1 strategy.

First, Vietnam’s strategic location within ASEAN positions it as a vital hub for global trade. Vietnam’s proximity to China enables seamless coordination for companies with operations in both countries. This geographic advantage supports efficient supply chain management, reduces logistical costs, and keeps Vietnam within convenient reach of established Asian trade networks.

Second, Vietnam’s commitment to market liberalization boosts its attractiveness to foreign investors. The country allows for 100% foreign-owned subsidiaries and offers tax breaks and other incentives that support international investment.

Additionally, Vietnam’s government provides substantial incentives for foreign enterprises and is dedicated to environmental sustainability, with net-zero goals set for 2050. This aligns well with German companies’ focus on high-tech investment, renewable energy, and eco-friendly practices, making Vietnam a natural partner in their expansion efforts.

Beyond Cost: Key Reasons Vietnam Leads in IT Outsourcing Choices

Vietnam is emerging as a key hub for German business interests, underscoring its strategic value as a trusted outsourcing partner in Southeast Asia. The country’s progress in software development is widely acknowledged, with Vietnam now ranking 12th globally according to the “Future of IT” report by Emerging Europe—outperforming established outsourcing markets like Ukraine, Argentina, and the entire African continent.

Manufacturing was one of the first key sectors that Germany invested in when it entered Vietnam in 1992, primarily attracted by the low labor costs. However, German investments have now expanded beyond manufacturing, with a growing focus on advanced technology sectors, reflecting Vietnam’s increasing role in high-tech development.

Bosch, a long-standing presence in Vietnam, plans to expand its software workforce by 2,000 employees next year. Currently, Bosch employs 6,200 people in Vietnam, with 4,000 dedicated to software development, and aims to increase this number to 6,000 by 2025. This expansion strengthens Vietnam’s role in Bosch’s global strategy and highlights its position as a top outsourcing destination for German companies.

#1 Highly Skilled Software Engineer

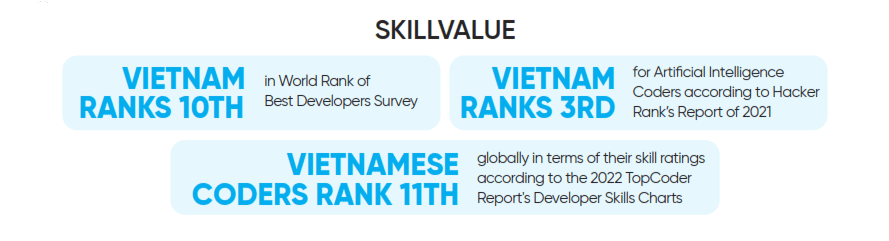

Vietnam ranks 10th in World Rank of Best Developers Survey.

Vietnam Ranks 3rd for Artificial Intelligence Coders according to Hacker Rank’s Report of 2021.

Vietnamese coders rank 11th globally in terms of their skill ratings according to the 2022 TopCoder Report’s Developer Skills Charts

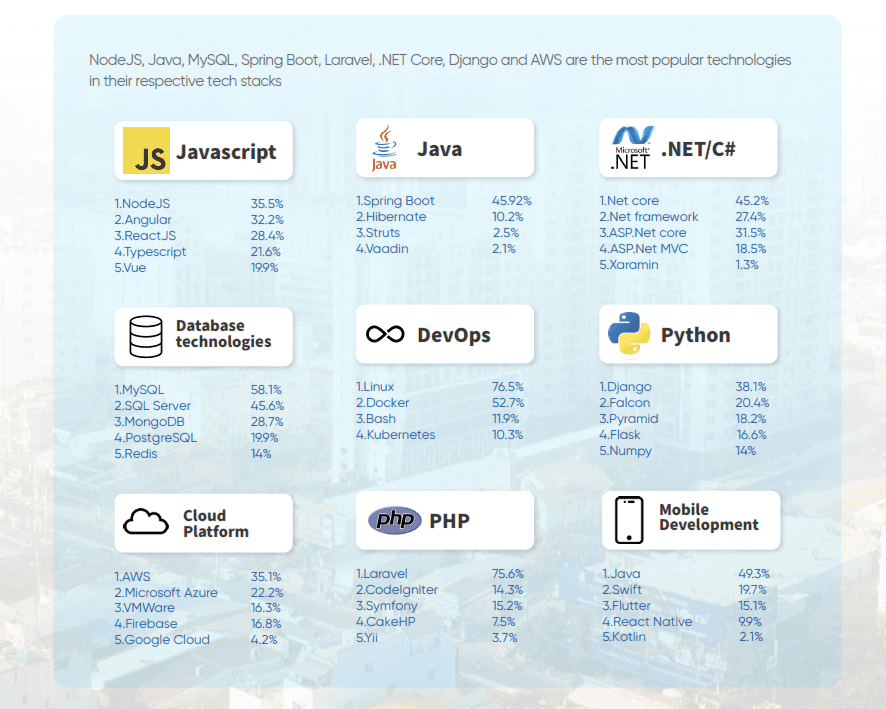

Top technology skills offered

#2 Attractive Cost

Vietnam offers an attractive cost for IT outsourcing services. The average hourly rate for a senior software engineer is around $22-$25, which is 30%-40% lower when compared to other popular outsourcing hubs like China (up to $40/ hr for senior level).

As reported by 2023 Kearney Global Services Location Index, Vietnam secured its 7th position in the “Best Countries to Outsource to in the World in 2023”, making it as the “Next Silicon Valley in Southeast Asia.”

#3 STEM-focused Educational Background

Vietnam’s educational focus leans heavily towards STEM (Science, Technology, Engineering and Maths), particularly on IT studies. Consequently, there’s a consistent supply of skilled IT experts proficient in English and familiar with global business practices.

Number of IT education facilities nationwide: 240 Colleges and Universities with 160 colleges and universities in Information Technology, Electronics & Communications, Information Security.

#4 Young & Dynamic Workforce

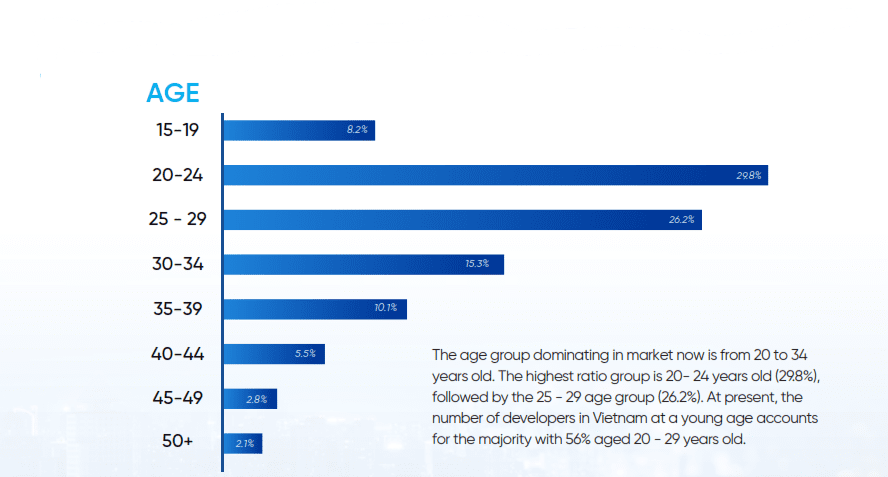

The age group dominating in Vietnam market now is from 20 to 34 years old. The highest ratio group is 20-24 years old (28.8%). At present, the number of Vietnamese developers at a young age account for the majority with 58.1% aged 20-29 years old.

#5 English Proficiency

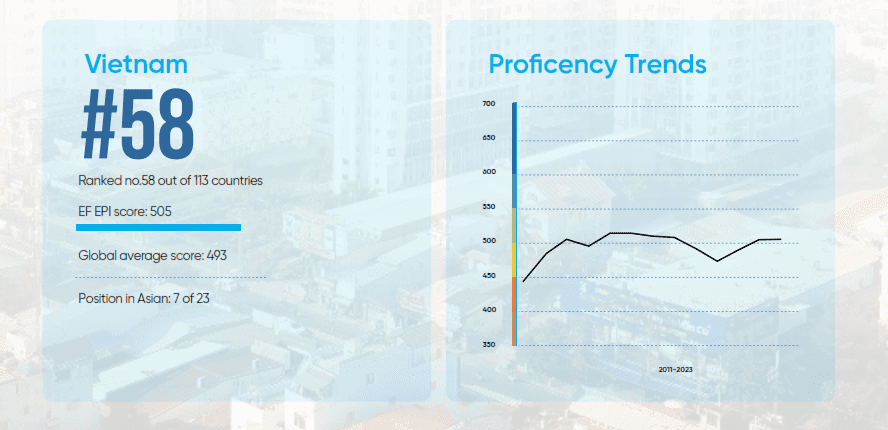

English stands as the second most widely spoken language in Vietnam, with a significant proportion of college graduates with a strong command of English. Vietnam’s proficiency in English ranked 7th in Asia and 58th worldwide in the EF English Proficiency Index 2023. As a result, approximately 90% of IT professionals in Vietnam possess intermediate or higher proficiency in English, enabling effective communication on outsourcing projects.

The Path Forward: Vietnam’s Role in Shaping German Companies’ IT Strategies

For German companies seeking sustainable growth and flexibility, exploring Vietnam’s IT landscape could be a pivotal step toward a resilient, future-ready business strategy. Embracing Vietnam as a part of the China + 1 approach not only mitigates risks but also opens doors to new opportunities, helping companies stay competitive in an evolving global market.

For prompt assistance in navigating Vietnam’s IT outsourcing market, simply complete the form below, and a CMC Global consultant will get in touch with you shortly!