In the high-stakes world of banking, financial services, and insurance (BFSI), risk management isn’t just about compliance, it’s about survival. Yet many companies unknowingly introduce a critical vulnerability into their operations by relying too heavily on a single outsourcing vendor.

A single breach, compliance failure, or vendor collapse can trigger catastrophic downtime, regulatory penalties, and irreparable reputational damage. What makes this particularly dangerous is how these risks often remain invisible until it’s too late to respond effectively.

These growing threats are why forward-thinking institutions are shifting toward multi-outsourcing strategies, and why destinations like Vietnam are becoming strategic solutions for risk-conscious firms.

The Hidden Dangers of Single-Vendor Dependency

When a financial institution’s entire IT operations depend on one vendor, that relationship becomes a single point of failure. Any disruption, whether a cyberattack, financial instability, or sudden talent attrition, can paralyze operations.

Compliance risks compound the problem. Outsourcing partners must adhere to strict standards like PCI DSS, FCA, and GDPR, but without competitive pressure, vendors may delay security patches, reuse outdated encryption, or deprioritize audits. If a vendor hasn’t updated its compliance framework in the past year, that should be a major red flag.

Beyond security, innovation also suffers. A monopolistic vendor has little incentive to improve efficiency or adopt new technologies. Many banks locked into single-vendor contracts report 20-30% slower adoption of critical advancements like AI-powered fraud detection, leaving them vulnerable to more agile competitors.

Why BFSI Firms Are Especially at Risk

Financial institutions face unique challenges that make vendor diversification essential. Modern banking systems such as fraud detection, KYC protocols, and payment processing often require security controls under zero-trust architectures. A single vendor means shared infrastructure risks, where one client’s breach can expose others, and limited customization for niche compliance needs.

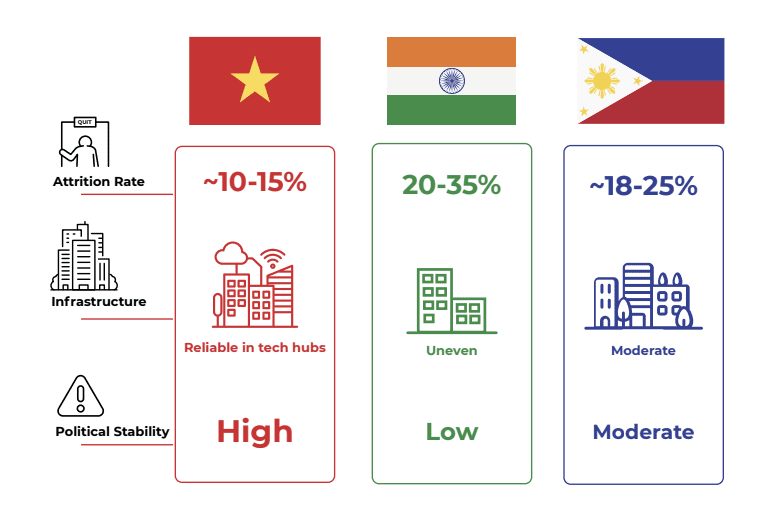

Geopolitical instability adds another layer of risk. Many banks still rely heavily on traditional outsourcing hubs like India or China, but India’s evolving data localization laws create compliance headaches, while U.S.-China tensions raise supply chain concerns. Vietnam, by contrast, offers political neutrality, strong pro-Western trade ties, and no history of data sovereignty conflicts, making it a stable alternative.

Scalability is another critical issue. When Open Banking surges or a merger demands rapid scaling, single vendors often lack the spare capacity to adapt, leading to costly downtime or dangerous security shortcuts.

How Multi-Outsourcing Mitigates Risk

The solution lies in strategic diversification. Leading banks now split workloads across multiple specialized vendors, assigning core functions like transaction processing to high-compliance partners while offloading non-core tasks such as QA and legacy system maintenance to cost-efficient providers. This distributed approach ensures no single failure can cripple operations.

Competition between vendors also drives better performance. When service providers know they’re being benchmarked, they proactively upgrade security, maintain stricter compliance, and offer more competitive pricing.

Vietnam has emerged as a particularly attractive hub for this model. Beyond cost advantages, it offers less than 10% attrition rates, compared to 20-30% in India, meaning far less disruptive talent churn. The country’s FCA and GDPR-aligned frameworks simplify compliance for UK and EU firms, while hybrid onshore-offshore models provide real-time oversight.

Actionable Steps for Risk Managers

The first step is conducting a thorough vendor risk assessment. Key questions include where their backup data centers are located, how many full-time employees are dedicated to your account, and when they last completed penetration testing. Warning signs include vendors deriving over 40% of revenue from a single client, a sign they may lack flexibility in a crisis.

Piloting multi-vendor strategies with low-risk, high-impact functions like regulatory reporting or penetration testing allows firms to test the waters safely. Contract structuring is equally important: demanding ISO 27001 and SOC 2 certifications, 72-hour breach disclosure clauses, and “knowledge transfer” penalties prevents dangerous lock-in scenarios.

Outsourcing Partnerships for BFSI Resilience

For UK BFSI firms seeking secure, scalable outsourcing, CMC Global offers distinct advantages. Their deep BFSI expertise spans fraud prevention, core banking systems, and regulatory compliance. A multi-shore delivery network across Vietnam, Japan, and Europe provides geopolitical risk diversification, while pre-vetted FCA, PCI DSS, and GDPR frameworks reduce compliance friction.

Read more: Navigating GDPR Challenges: CMC Global’s Blueprint for Secure IT Outsourcing

The greatest outsourcing risk isn’t cost, it’s complacency. Institutions that wait for a breach to act will pay tenfold in fines and lose trust. The solution is clear: break free from single-vendor lock-in, leverage Vietnam’s stability and talent pool, and partner with experts like CMC Global to build a truly resilient operation.

The question isn’t if your current vendor model will fail—but when. Companies that diversify now will be the ones still standing when crisis strikes.

Contact our financial services specialists to schedule your complimentary outsourcing risk assessment and explore tailored multi-vendor strategies for your organization.