Vietnam has become an attractive investment destination for German companies, combining cost-effective IT outsourcing with a skilled talent pool, and experience with industry giants like Bosch, Siemens, and Schaeffler. Discover the strategic advantages Vietnam offers to fuel your business growth.

German Investments Thrive in Vietnam’s Offshoring Initiative

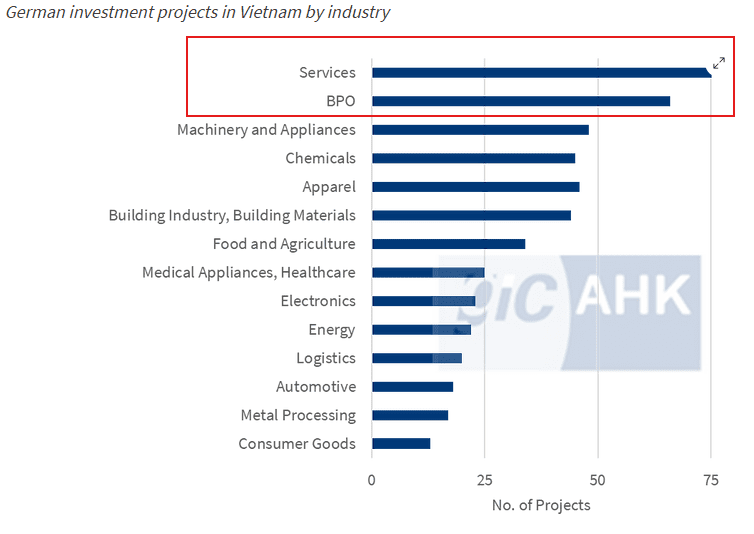

In addition to the Free Trade Agreements (FTAs) ties with the EU and the German -Vietnamese bilateral cooperation in developing Vietnamese skilled workers, German investment began to flourish with more than 530 companies from Germany investing roughly $3.6 billion in Vietnam.

This trend underscores Vietnam’s capacity as a promising business hub with reasonable and high-quality IT personnel, open investment environment and growing local market.

¼ of German investment projects are Services and BPO (Source: GIC/AHK)

Leading Germany Firms Establish Offshoring Hubs in Vietnam

Several major German companies have established a foothold in the country, leveraging the country’s favorable business environment and skilled workforce.

Bosch

With over a decade of growth in Vietnam, Bosch has achieved significant milestones in manufacturing, green energy, and R&D.

Bosch Global Software Solutions Vietnam (BGSV) aims to expand its workforce to 6,000 by 2025, driven by Vietnam’s updated legal framework that encourages high-tech investments in areas like semiconductors, AI, and software production.

Bosch also nurtures local talent through its technical apprenticeship center, which has graduated 134 students now working globally.

Thyssenkrupp

Thyssenkrupp, a comprehensive supplier to the cement industry, has relocated its Asia-Pacific cement headquarters from Singapore to Vietnam. This move underscores the availability of a motivated, young, well-educated workforce in Vietnam, contributing significantly to the positive business environment.

Thyssenkrupp plans to develop its automation center in Vietnam to create competitive technologies, leveraging local human resources for regional projects and ideas to serve local customers effectively. This strategy aims to provide products, services, and technologies at more competitive prices.

STADA

STADA Pymepharco has been a reliable and important pillar of the Vietnamese healthcare system for more than 30 years and has strong growth plans.

“We employ 2,000 dedicated people in Vietnam, which is our most important market in Asia. It will also serve as a hub in the future for supplying surrounding countries,” stated STADA CEO Peter Goldschmidt at the establishment of its new head office in Ho Chi Minh City.

The presence of new entrants from Germany

In addition to the first-movers, new German entrants like E.ON and Ecoligo are also setting an eye for Vietnam to build their delivery team and accelerate partnership with local businesses and expand their footprint, leveraging local talent, competitive technologies, and the country’s favorable business conditions to build their team

Why Vietnam is A Rising Tech Hub?

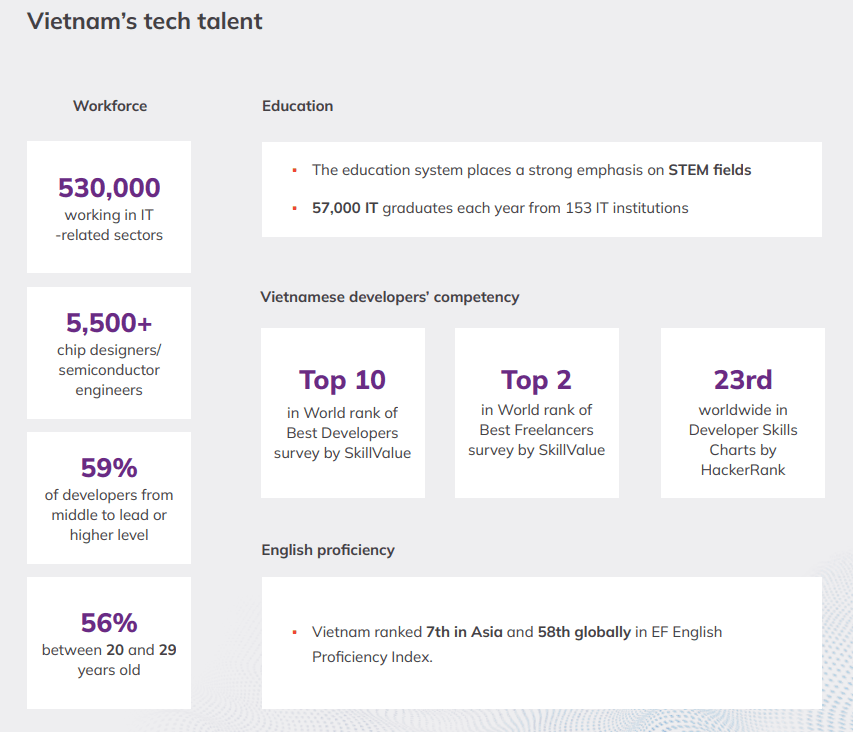

Tech-savvy IT Talent

- A large and promising talent pool: With an intensive budget for STEM education, Vietnam promises 500,000+ tech personnel working in IT-related sectors.

- Professional IT engineer workforce: Vietnam ranked 7th following Global Service Location Index in 2023 and among the countries with the highest-qualified developers by TopCoder (TopDev, 2023). This reflects the outstanding improvement of Vietnamese’s competency compared with international counterparts.

- English Proficiency: Vietnam’s proficiency in English ranked 7th in Asia and 58th worldwide in the EF English Proficiency Index 2023 (higher position than India, China, and Indonesia)

Culture similarities between Vietnam & Germany

Vietnam and Germany share several cultural similarities that make Vietnam an ideal offshoring destination for German companies:

- Strong work ethic: Both cultures value diligence, discipline, and a strong work ethic, ensuring high productivity and quality in offshoring projects

- Respect for Hierarchy: Clear roles and responsibilities in offshoring projects can be maintained through respect for organizational structure.

- Emphasis on Education and Skills: Both countries prioritize education and skill development, resulting in a highly skilled workforce that can meet the demands of German businesses.

Cost Optimization

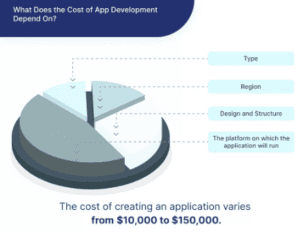

Vietnam offers an attractive cost for IT outsourcing services. The average hourly rate for a software device is around $20, which is notably lower when compared to other popular outsourcing hubs.

See details in our insightful report: Unlocking Vietnam’s Potential: Bridging the Global Tech Talent Gap.

| Region | Country | Hourly rate |

| Southeast Asia | Vietnam, Malaysia, Philippines | $18 – $71 |

| Central & Eastern Europe | Poland, Romania, Hungary, Bulgaria, Belarus, Czech Republic, Austria, Slovakia | $26 – 95 |

Leveraging Expertise & Experience

Several major German companies, such as Bosch (automotive), Stada – Pymepharco (medical equipment), Messer Gases (chemicals), and Siemens (electronics), have established a strong presence in Vietnam, investing in skill and talent development. New entrants from Germany can benefit from this skilled workforce and the experience of working with industry giants.

When planning to extend your business into Vietnam, your Offshore Development Center (ODC) can provide essential insights to help you navigate the local market. You can assign your ODC to:

- Local Market Customization: Tailoring products to meet local demands.

- In-depth Market Research: Understanding user needs and market trends.

- Design Alignment: Ensuring product designs resonate with local preferences.

This strategic approach helps German companies effectively navigate the Vietnamese market and leverage the expertise of their ODC teams.

Ongoing coverage

An Offshore Development Center (ODC) in Vietnam can provide significant advantages for German firms:

- 24/7 Business Continuity: Seamlessly take over operations once your in-house team in Germany finishes for the day, ensuring continuous business operations.

- Accelerated Development Cycles: The time zone difference (Vietnam: UTC+7, Germany: UTC+1/UTC+2 in summer) allows for around-the-clock development, speeding up the time-to-market for new features or products.

- Consistent Maintenance and Swift Incident Response: Continuous coverage for maintenance and support tasks, with the ability to quickly detect and address security incidents.

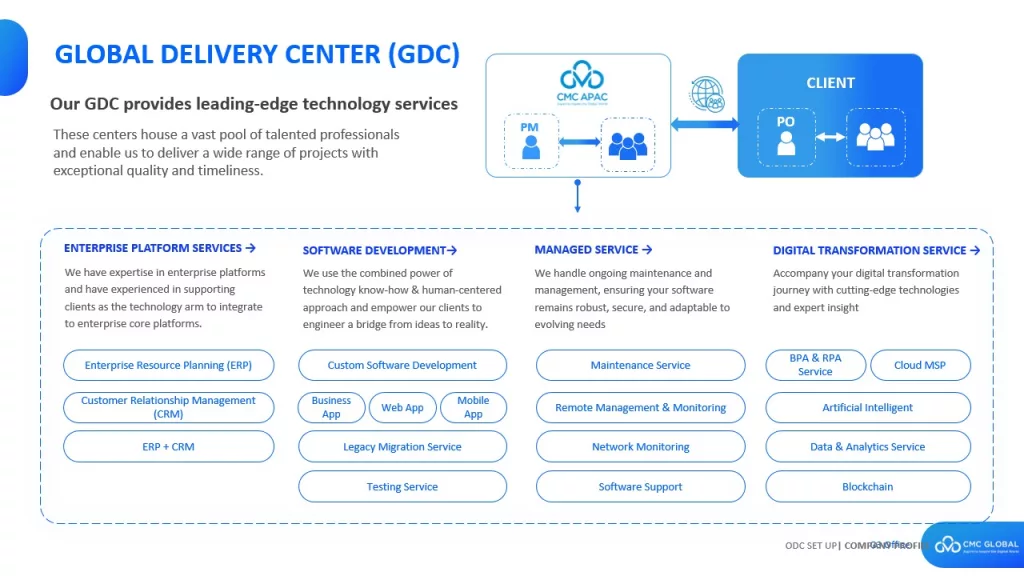

CMC Global – Our GDC provides leading-edge technology services

At CMC Global, we offer top-tier software engineers to fulfill all your business requirements, tailored specifically for the manufacturing and industrial sectors in Germany. Our comprehensive software development services include:

- Custom Web Application: Developing bespoke web applications that meet the unique needs of your manufacturing processes

- SaaS Applications Development: Providing scalable and secure SaaS solutions to streamline your industrial operations

- Smart Factory: Implementing connected machines, cloud migration, industrial IoT and digital twins to optimize manufacturing processes.

In addition, we deliver customized testing solutions for your projects, ensuring optimized outcomes. Our quality assurance assessments come with a comprehensive report that highlights any detected issues and provides detailed instructions for their resolution.