But there’s a catch: AI only flourishes with clean data. To embark on an AI-ready journey, banks should begin with evaluating their current data landscape and determining the steps to ensure data is accurate, and ready to fuel AI-driven initiatives.

AI is Changing Mission Operations

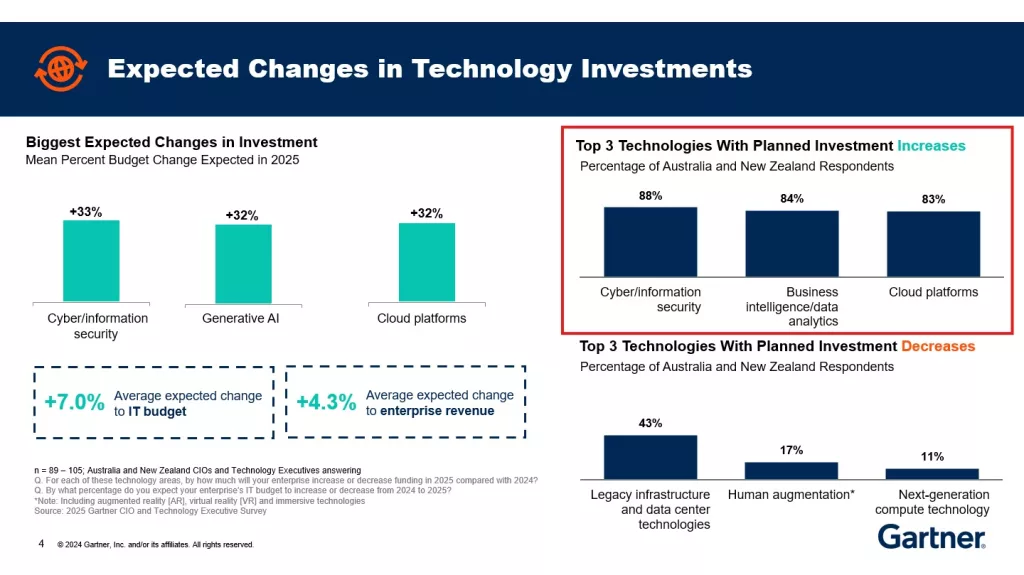

In The 2025 Gartner CIO and Technology Executive Survey, 84% of CIOs in Australia and New Zealand mentioning data analytics as one of their top two technology priorities. This is closely followed by generative AI (Gen AI) (81%).

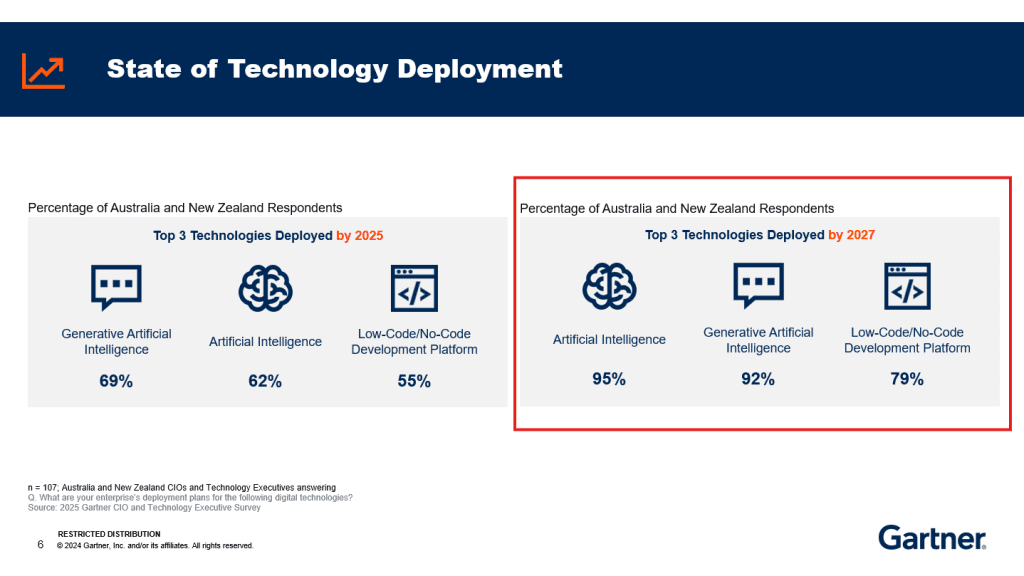

With a higher level of emergent tech deployment, 95% said that they are planning to deploy AI, and 92% GenAI.

AI-fueled banks benefits include:

- Faster, deeper insights: Machine learning can sift through data faster than humans to uncover patterns and make helpful predictions and market trends with precision.

- Enhanced efficiency: AI automates repetitive tasks like data entry, invoicing, payments, and other administrative.

- Improved accuracy: AI systems excel at detecting fraud, optimizing investment strategies, and delivering more accurate loan and credit decisions, reducing errors and boosting financial performance.

APRA (Australian Prudential Regulation Authority) recently highlighted the potential of AI to lower costs and improve customer experiences in Australia’s banking sector, encouraging banks to experiment with advanced AI technologies.

Major Australian banks are increasingly adopting AI to enhance operations, using generative AI to help IT teams write better code for customer apps and fraud systems.

However, despite AI being recognized as a strategic priority, many organizations are still in the early stages of adoption. According to the “State of AI in Australia” report, one key challenge is poor data quality, with a Gartner survey revealing that 70% of AI programs fail due to incompatible or inadequate data.

How Banks CDOs Prepare For AI-Ready Data?

Financial institutions need high-quality, structured data—often referred to as “metadata” – for training and validating AI solutions.

This data must be both human- and machine-readable to simulate real-life scenarios accurately. Poor data collection or processing can lead to errors in AI model behavior.

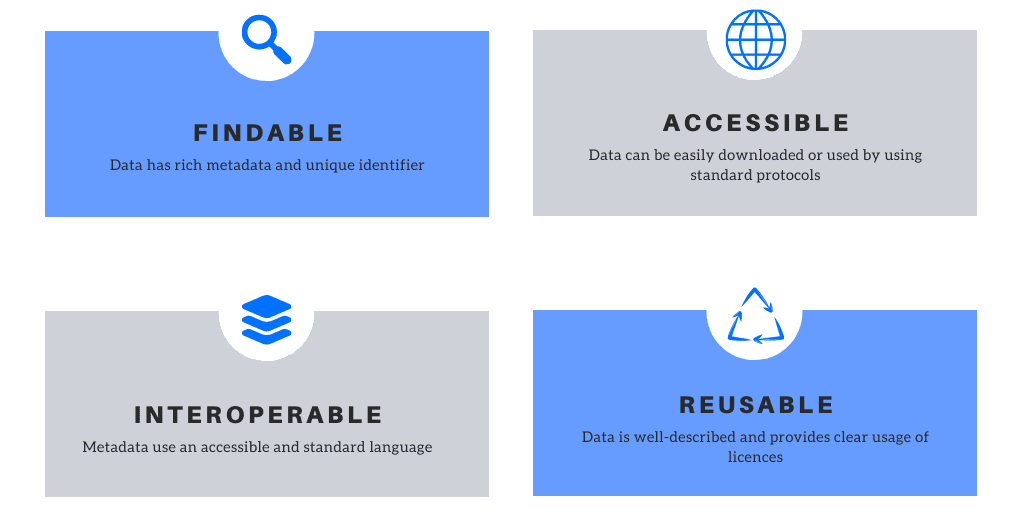

Thus, CDOs (Chief Data Officers) play a critical role in acquiring and storing clean, large-scale data that is both accessible and reusable to support AI adoption. To ensure data readiness, CDOs must ensure their organization’s data adheres to FAIR principles:

- Findable: Data must have rich metadata and a unique identifier to ensure easy discovery.

- Accessible: Data should be governed by standardized protocols for access, with proper authentication and authorization, even if privacy restrictions apply.

- Interoperable: Data and metadata should use shared, standardized formats and reference other data or information clearly through identifiers.

- Reusable: Data must include accurate metadata, clear usage licenses, and detailed provenance to ensure it can be effectively reused.

Executive Plan for Data Readiness and AI Adoption

Step 1. Build a key stakeholder network

Successful AI begins with connecting key stakeholders to the data products in your organization.

For example, policymakers define the form’s structure, data engineers handle data collection and transformation, and data scientists analyze it to apply AI. Constituents are the end users. Effective communication and tracking among all stakeholders enhance data findability and usability.

In addition to findability, ensuring data accessibility is crucial, especially if the broader public and researchers are expected to benefit from and use the information.

Step 2. Develop a robust data transformation strategy

To successfully implement AI, organizations must develop a strategy for data transformation, ensuring it’s interoperable and usable across platforms.

CDOs and tech leaders should focus on three key pillars for AI-ready data:

- Improve data quality: Correct erroneous data, missing values and spot check your data for accuracy, completeness, and risk for bias

- Consolidate your data: As your data is scattered across different systems and formats, try advanced data integration to analyze and work on large volumes of data

- Invest in data infrastructure: Upgrade data storage and processing where necessary, so you can analyze large volumes of data.

Read more: Saving $1 Million by Migrating Legacy Enterprise Data Platforms to Azure Synapse – CMC Global

Step 3. Enable data security, privacy, and trust

Data transformation must prioritize security and privacy, adhering to legal frameworks like the NDB scheme and OLA Act. Privacy should be embedded into data architecture to ensure robust protection.

To make data both reusable and secure, organizations must regulate user access and employ cloud-based machine learning algorithms that identify weaknesses in security protocols proactively.

Achieve Data Readiness with CMC Global

AI’s potential to transform the banking sector and create new opportunities is immense, but it hinges on one critical factor: the readiness of the data we feed into these intelligent systems.

Learn more about how CMC Global can help your organization prepare for AI by taking honest assessment of their current data readiness, providing expert data analytics solutions, ensuring high-quality, secure, and AI-ready data.

Contact us for a free consultation to discuss your IT requirements.